—Taking 72 excellent sustainable development companies in Kansai as an example

(with investment case analysis)

Tokyo Shoko Elisachi Co., Ltd. published "2025 Kansai Edition Japan's Top 8% A-level Excellent Companies". This article analyzes the data of 72 entrepreneurs interviewed. There are some findings, which may have the characteristics of Kansai, or may be a perspective for analyzing the Japanese entrepreneurial group.

First, there are 7 female entrepreneurs (representatives) among the 72 entrepreneurs, accounting for 9.72%. This data is obviously higher than the general impression. In the Fortune 500, the number of companies with female CEOs will account for 8.8% in 2022.

Second, among the 72 companies, the specific distribution in the Kansai region is: 42 in Osaka Prefecture, 8 in Kyoto Prefecture, 8 in Hyogo Prefecture, 8 in Nara Prefecture, 2 in Shiga Prefecture, and 4 in Wakayama Prefecture. Osaka Prefecture accounts for 58.33%.

Third, among the 72 companies, the distribution of the birthplaces of entrepreneurs is: 29 in Osaka Prefecture, 8 in Kyoto Prefecture, 12 in Hyogo Prefecture, 7 in Nara Prefecture, 4 in Shiga Prefecture, 1 in Okayama Prefecture, 4 in Tokyo, and 5 in Wakayama Prefecture. Entrepreneurs born in Osaka Prefecture account for 40.28%. The proportion of existing companies is 18.05 percentage points higher than the proportion of the population of the entrepreneurs' birthplaces. This shows that Osaka has attracted entrepreneurs to start businesses in the Kansai region.

Fourth, from the age of entrepreneurs, among the 72 entrepreneurs, 8 were born in the 1940s, 5 were born in the 1950s, 27 were born in the 1960s, 21 were born in the 1970s, 10 were born in the 1980s, and 1 was born in the 1990s. Entrepreneurs from the 1960s to the 1970s accounted for 66.67% in total. That is to say, nearly 70% of entrepreneurs are between the ages of 45 and 65.

Fifth, from the perspective of the level of education received by entrepreneurs, 8 people have studied abroad to receive higher education, accounting for 11.11%. The most graduates from the same university are Kinki University (4 people), followed by Kansai University (2 people) and Doshisha University (2 people), and Kansai University (2 people). There are 6 people from Kansai's four major private universities, Kansai Gakuin University (1 person), Doshisha University (2 people) and Ritsumeikan University (1 person). Others from famous universities or national public universities include Osaka University, Keio University, Tokyo Institute of Technology, Kanazawa University, and Fukui University, each with 1 person. There are 11 people who graduated from famous private universities and national public universities, accounting for 15.28%. There are 18 people who graduated from famous private universities and national public universities and received higher education overseas, accounting for 25%. In other words, one in every four entrepreneurs graduated from a famous university or studied abroad.

Sixth, among the 72 companies, there are 17 companies that have been in business for more than 50 years and have more than 100 employees, accounting for 23.61%. Among the 72 companies, 2 were founded in the 1930s, 6 in the 1940s, 8 in the 1950s, 10 in the 1960s, 15 in the 1970s, 3 in the 1980s, 13 in the 1990s, 8 in the 2000s, 4 in the 2010s, and 1 in the 2020s. The distribution was more balanced from the 1940s to the 2000s, but was less in the 1980s. What was the reason? The Japanese economy was still growing rapidly in the 1980s, but some studies have shown that Japan's high growth period ended in the late 1970s, so the new companies and entrepreneurship in the 1980s were at a low point.

Seventh, among the 72 companies, 11 were inherited by children, accounting for 15.28%.

The data analysis of these seven aspects is difficult to give an accurate and distinct summary of characteristics due to the lack of comparison. There are roughly four aspects that can be initially summarized: 1. Osaka has a relatively large influence in the Kansai region. In addition to Kyoto's own strong independence, there are entrepreneurs who were not born in Osaka and came to Osaka to start businesses and innovate, especially those from Kobe, Shiga and Wakayama; 2. The sustainable development characteristics of enterprises are more obvious, the life span of enterprises is generally longer, the proportion of family inheritance is relatively low, and the openness is strong; 3. The level and level of higher education received by entrepreneurs are relatively high; 4. The age and gender distribution of entrepreneurs is relatively balanced and diverse, reflecting the strong fairness of age and gender.

with investment case analysis

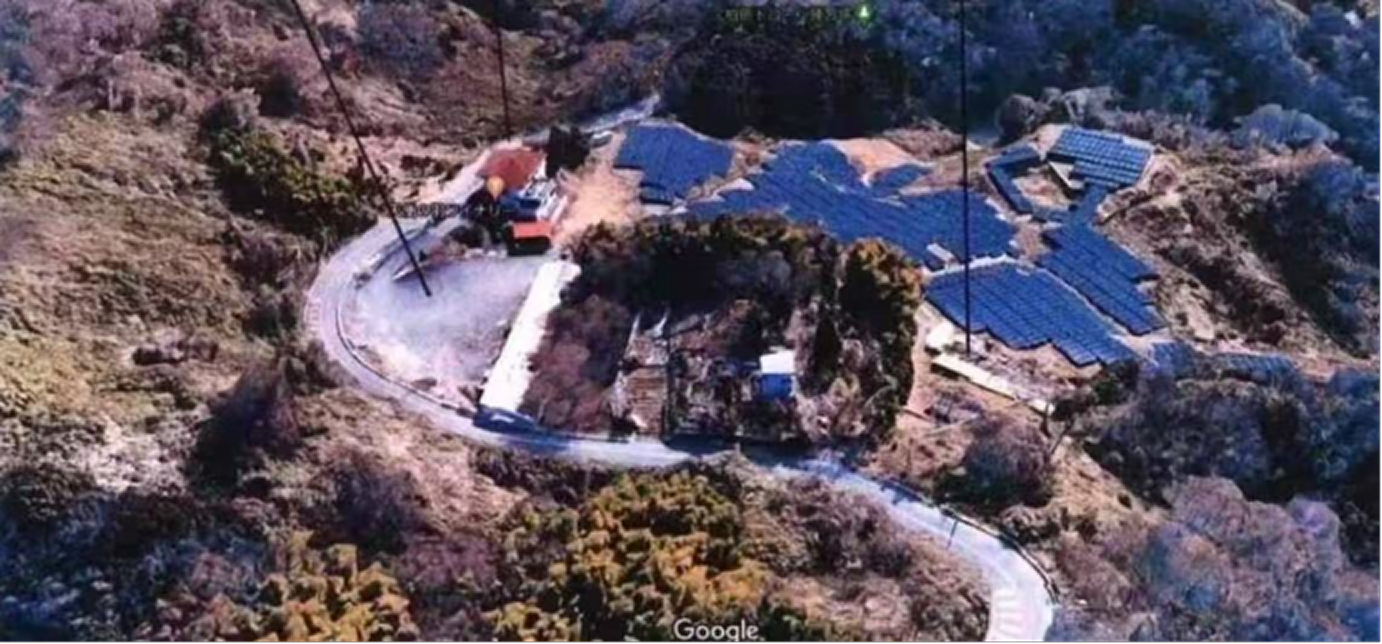

First, we continue to focus on the strategy and path of the revival of "Hayamizu Sanso". We searched and analyzed three video materials on the Internet.

1.https://youtu.be/vWo_oRUAxGA?si=DexVF2kqJ1mLDpaG. It records the operation of "Hayamizu Sanso" around 2013.

2.https://youtu.be/H1qpWwFxieM?si=BKvjbM_NwcdUqFMM. It analyzes that since the Edo period, the road passing through "Hayamizu Sanso" is an important road connecting Osaka and Nara. After World War II, the construction of this road was discussed again, but the plan was eventually abandoned. The film analyzes the historical geography of the "Hayamizu Sanso" area.

3.https://youtu.be/_ksS3tqajCY?si=GgxXRmQKj8OKpfEl

This video analyzes that Haraya Sanso is a yakiniku restaurant with accommodation in Daito City, Osaka Prefecture. It opened around 1970. The first floor of the three-story building is a yakiniku restaurant for ordinary guests, the second floor has many large rooms for banquets, and the third floor is for accommodation. There are separate baths for men and women next to the villa, which can be used by guests. The villa is located halfway up Mt. Ikoma. The red neon sign "Haraya Sanso" is very eye-catching at night, and it is a popular attraction visited by many local residents. Due to the heavy rain in western Japan in July 2018, part of the first floor was damaged by mudslides and could not be operated. Restoration was abandoned. Now it is called a spiritual spot due to aging, desolate appearance and illegal dumping. Although the interior was explored by drone, it was graffiti everywhere and in a desolate state.

Second, in the past week, several acquisitions were involved, and some objects were acquired by professional operators because of their good potential.

It has a superior geographical location and good foundations in all aspects, and can be renovated and put back into rental or operation.

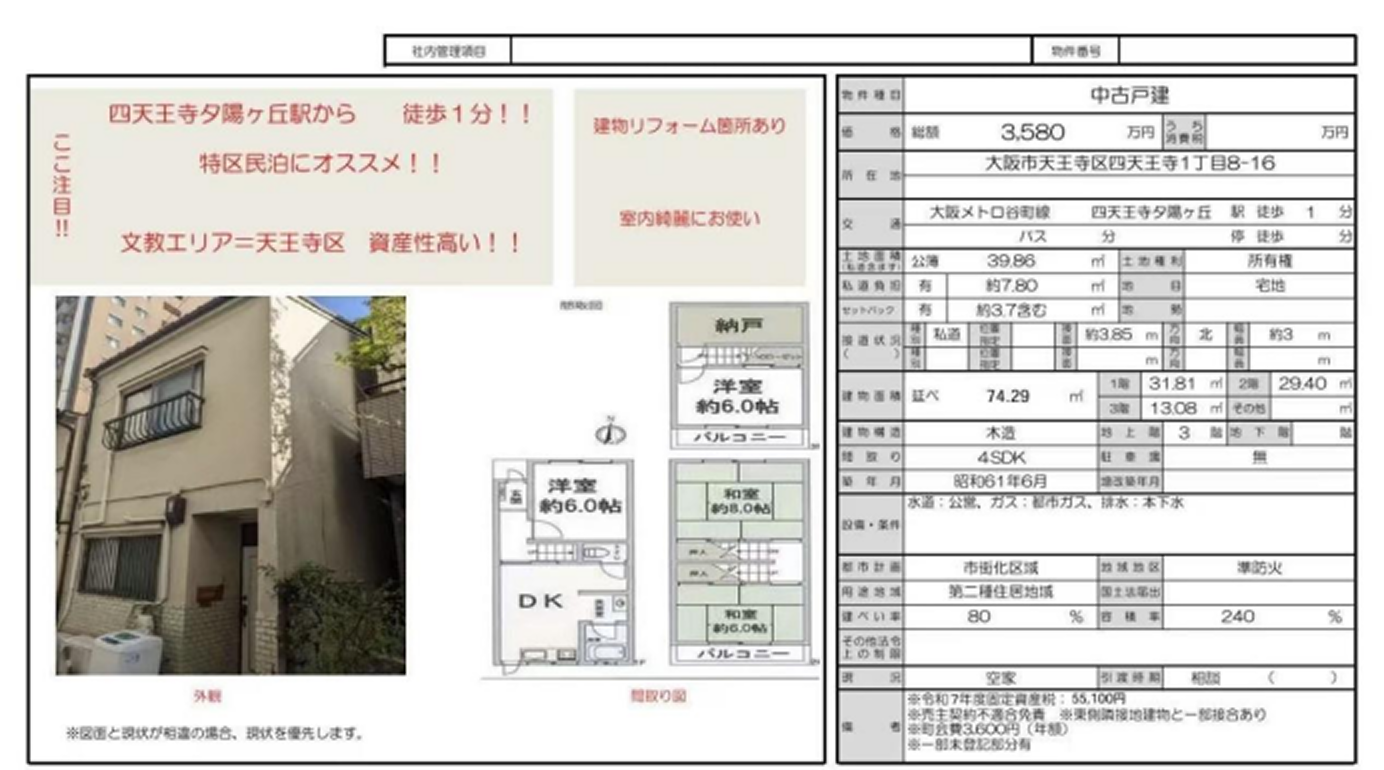

This house in Tennoji district is only one minute away from the station. The final buyer is a real estate company owner. It is planned to be renovated and then sold, and it is expected to be sold for 50 million yen. The final transaction price of this house is 28.5 million yen.

We have inspected this property on site. It is located near Nanboku-dori Road and 10 minutes away from JR Teradacho Station. It is suitable for living and hassle-free for renting. A good rental property is more stable than a B&B and has a high rate of return.

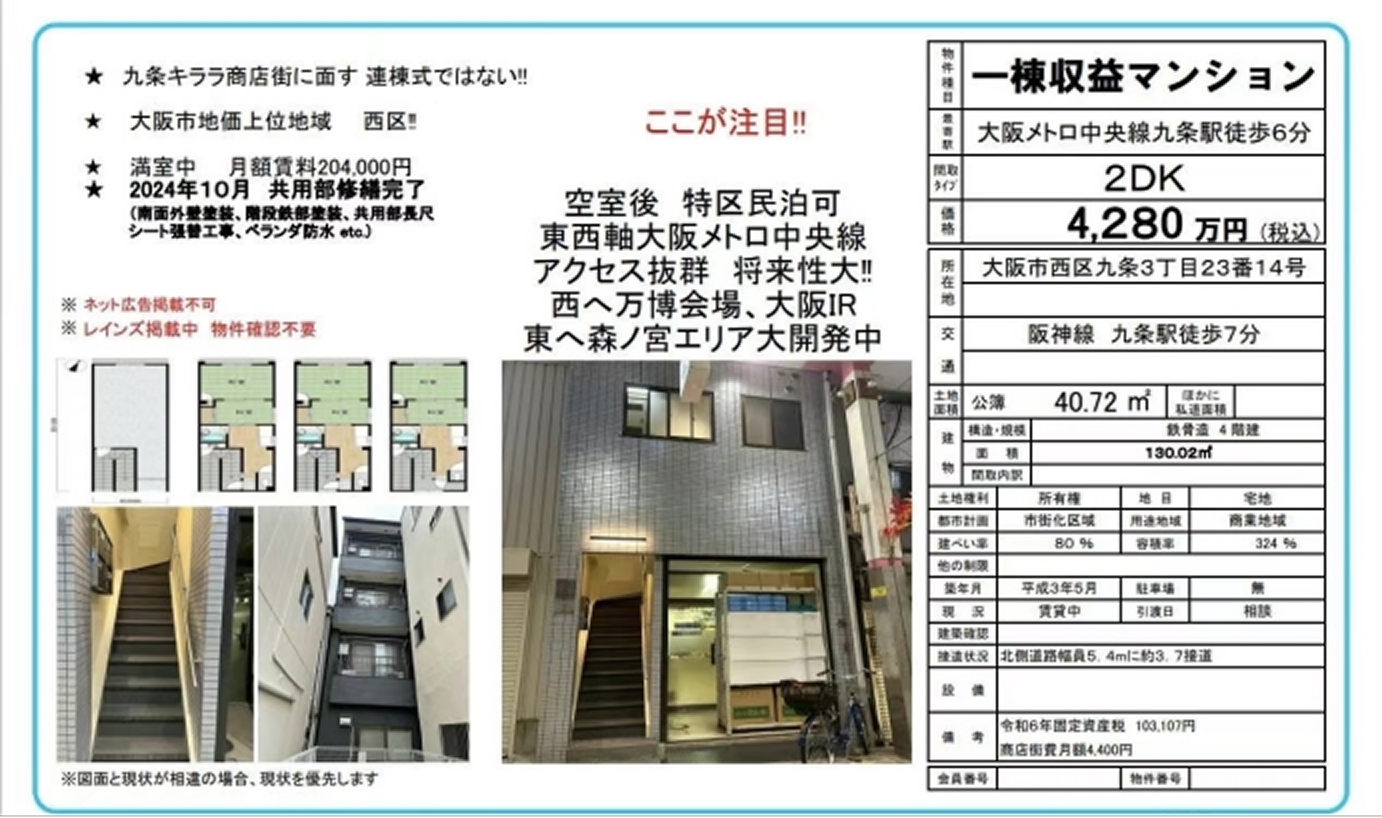

This house on the shopping street was acquired a year ago. After the acquisition, the facade was painted. The residents on the third and fourth floors moved out and renovated it into a B&B. Recently, it was also acquired by a B&B operator, and the final selling price was 50 million yen. When it was listed at 42.8 million yen, there were still residents on the third and fourth floors, and it had not been renovated yet.

We still maintain some of our previous judgments (Osaka):

The sales amount of new apartment houses in the city center will continue to rise

The increase in bank interest rates

The price of newly built single-family houses in the unpopulated areas around Osaka will drop. (B&Bs with bad locations have begun to withdraw - especially in Xicheng District, which further verifies the supremacy of downtown locations)

This has caused many people with rigid demands to be unable to buy ideal real estate, and the demand for mortgage market continues to be very strong

1. If you have funds, please buy an investment building (dry and wet areas should be separated, and if there is no elevator, you can only go to the 3rd floor as much as possible. Of course, if there is an elevator, it should be able to accommodate 6 people. If it accommodates 4 people, it is slow to change from home to commercial. It is faster to take the stairs);

2. If you don’t have funds, actively buy a second-hand single-family building within 10 minutes of the station. Remember to buy a single-family building! And the premise is that it has not been renovated;

3. It is best to borrow a bank loan. Using the principle of leverage, maximizing asset formation is also the fastest way to expand the scale of real estate;

Investing in buying a house, based on professional theoretical knowledge, through actual successful case analysis, avoid being bound after buying a house, and truly enjoy the benefits and fun brought by investment.

Practice the Win Win principle. Let all participants benefit!

Merger and acquisition project between two wineries

1. Koko Factory Store, Kashiwara City, Osaka Prefecture

The equipment is under the name of the legal entity Hokuno Production Technology Sales Co., Ltd.

The land is about 5,600 square meters.

Price: 450 million yen

2. Chiba Prefecture Japanese sake brewery (including brewery machinery and equipment)

Merger and acquisition: 100% transfer of shares

Number of employees: about 15 people

Amount: 500 million yen (shareholding)

Founded: about 1800s

Main financial period: (March 2024 period)

Deficit. Transfer due to the owner's advanced age and poor health.

We have many award-winning well-known brand products, including light and dry Daiginjo and Tokusen Daiginjo, which have a smooth taste and rich aroma and have won awards in international competitions such as the National New Sake Tasting Competition and the Master of the Brewery Competition. Land: 1303 tsubo; the manufacturing plant building is owned by the company.